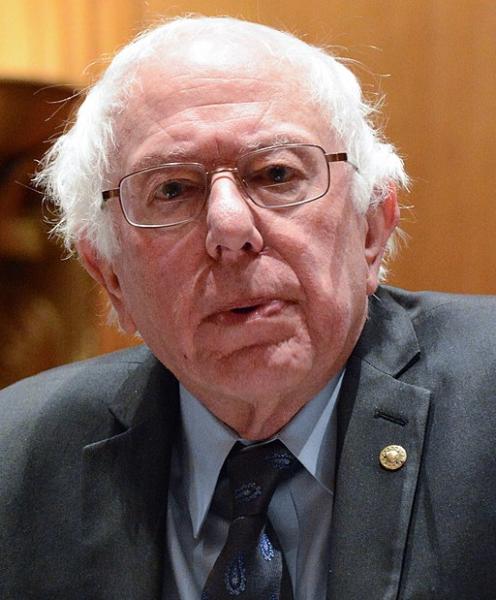

The Mercatus Center, alternately characterized as a libertarian think-tank or a “Koch [brothers] backed think tank” released a financial analysis of Senator Sanders' Medicare for All Act, the only single-payer legislation currently proposed. The media trumpeted the savings or costs, depending upon their philosophical (read political) leanings, and as always go for headline rather than substance. Let’s take a look beneath the ranting and raving.

Disclaimer of Bias

I would argue that we already have a single payer system, you and me, funneling money into healthcare through insurance premiums, cost-sharing (another term for out-of-pocket expenses), our work and taxes. The federal and state governments and commercial insurance carriers redistribute the money; they do not provide it.

Costs

Under Senator Sander’s proposed legislation, healthcare expenditures in the federal budget will increase from three sources beyond merely shifting the spending by the commercial carriers.

- By providing health care to those currently uninsured.

- By increasing the scope of services to include as Medicare does, dental, vision, and hearing. It is reasonable to assume that more individuals will take advantage of these services, as they are essential to our overall health and quality of life. But many of these costs are currently uncovered by commercial insurance or out of pocket.

- Cost sharing is a part of traditional Medicare, requiring an annual deductible and a 20% co-payment for physician services. [1] But Senator Sanders' plan requires “no cost-sharing, including deductibles, coinsurance, copayments, or similar charges be imposed on an individual.” [2] Cost-sharing was designed and implemented to increase patient accountability for using health care, to have “skin in the game” and counter the belief that if it is free, it will be abused, a version of the tragedy of the commons. The studies on the impact of cost-sharing on utilization are mixed, but irrespective of your sentiments about cost-sharings' role they are part of the costs and will accrue to the single payer, the feds.

- Long-term services and supplies for the chronically ill include nursing care at home or in an institution. It currently consumes 20% of all Medicaid payments, our current governmental funding source. Senator Sanders' bill requires “maintenance of effort” concerning these services so we can anticipate additional expenditures by the government covering the uninsured and those who currently have their own commercial coverage shifting the expenses to the government.

Savings

The Sanders' proposal reduces costs by reducing payments to pharmaceutical companies, providers, and administrators.

- Drug cost reductions are predicated upon the secretary of Health and Human Services being empowered to negotiate the lowest drug prices possible. But the effectiveness of this reduction is limited for two salient reasons. Pharmaceutical expenditures reflect only 10% of spending and 85% of the drugs currently sold are generics, priced 75 to 90% less than their brand name equivalents. So for a majority of our current drug therapies, much of the cost reduction has already been achieved. More importantly, the savings from reduced pharmaceutical costs do not consider the rapid rise in biologics, drugs that are both far more expensive than most of our current treatment options, and represent the future’s greatest therapeutic potential.

- Under the proposed legislation, hospitals, physicians, and other providers will be paid at Medicare rates. Provider income is a blend of what percentage of their patients are privately insured, have Medicare or Medicaid, the “case-mix.” In the worst case scenario, physicians who rely primarily on commercial insurance would see payment reductions of 40%. The same would hold true for hospitals and health systems but to a lesser degree. CMS’s Office of the Actuary projects that even without payment reduction, “over 80% of hospitals will lose money treating Medicare patients” in 2019.

- Administrative cost rates measure our administrative expenses. They are calculated as a percentage of spending - when administrative costs are held constant, the more spent on health care, the lower the cost rate. Given identical administrative costs, Medicare with older, more chronically ill beneficiaries than commercial insurance will have a lower administrative cost rate than commercial insurance. There will be savings as profit is wrung out of the system, but it just will not necessarily be as substantial a savings as the anticipated 7%.

- Identifying fraudulent health claims is part of administrative costs. Audits and chart reviews cost money in searching for cheats. The Government Accountability Office found $96 billion in improper Medicare and Medicaid payments, twice the expenditure for administering the programs. There is no reason to believe that this diversion will not continue unless more money is spent on reducing fraud – an unaccounted expense that will also diminish the anticipated reduction of administrative costs.

As you can see, there are many assumptions at play here. That providers will take a hefty pay cut, that hospitals can be run on a continuing deficit (like the federal, not the state governments), and that the government will be a more efficient administrator. You can also see that all the talk about excess expenses reflects both the shift of all the current costs to the single payer along with the additional real expenditures in caring for the currently uninsured and expanding the scope of healthcare provided. But how will it affect us?

The impact on the taxpayer

Senator Sanders' bill calls for the elimination of employer-sponsored health insurance and its tax preferences. What to do with this windfall? The assumption is that it will be passed along to the employees as taxable income. What portion of the windfall falls to the individual tax payer is based upon how much the company shares and your tax rate. And if you think you will get to keep the portion of health insurance premiums you paid, you may be in for a surprise. Shifting the expenses onto the federal government will require new revenue. It may be somewhat exaggerated but “doubling all currently projected federal individual, and corporate income tax collections would be insufficient to finance the added federal costs of the plan.”

Single-payer is intuitively better; it just breaks down in the details. Senator Sander’s initial proposal is more of a sound bite than a realistic plan. This single-payer shifts how we pay, from premiums and taxes to taxes and perhaps a surcharge here or there. But the savings come from significantly lowering payments to providers, which may unintentionally reduce access as hospitals close and older providers leave further exacerbating a perceived physician shortage. The savings in pharmaceutical may well be lost as biologics, and their associated expenses become the standards of care. And one last consideration, how many of the 2.6 million or more people employed by insurance companies will find themselves unemployed?

We can pick apart the Mercatus whitepaper arguing about its assumptions and calculations or the possible political leanings of the authors. But neither the politicians or the media, the people we have entrusted with finding and communicating a solution to rising health care costs are doing their job. They continue to express their elitism, either apparent or unconscious, saying we just wouldn’t understand or distracting us with headlines and soundbites. We deserve better from our elected leaders and our chosen media.

[1] Medicare Advantage and the Medigap programs remove these cost-sharing charges either by restricting some hospital access in the case of Medicare Advantage and by a separate monthly charge for the Medigap programs.

[2] There are some exceptions meant to nudge people toward the use of generic drugs.

Source: The Costs of a National Single-Payer Healthcare System Mercatus Center