An article in Modern Healthcare caught my eye, writing about community benefit, the portion of money spent by a non-profit instead of taxes. First, let me remind you, the term non-profit refers to a company’s, in this case, health system’s, tax status not its bottom line. Non-profits can be wildly profitable. The bargain is that a non-profit will spend a portion of their income on community services rather than paying the tax collector; consider it a way of directing your taxes to activities that you, rather than the government, believe benefit the community.

The health system at the center of the current discussion is Sutter Health, a northern California based system, but I have written before about Cleveland Clinic’s similar problem, this is not an isolated concern. Community-benefit is a somewhat nebulous term which makes for devilment and remuneration for accountants, attorneys and sometimes the community – but to which community and while we are on the topic, what benefit?

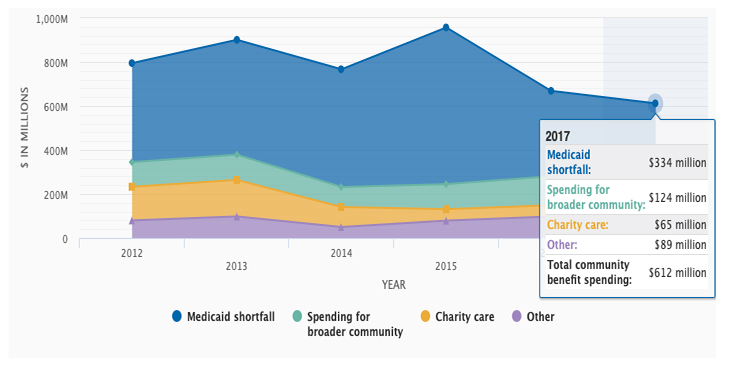

Here is a screenshot from the Modern Healthcare article:

The total “community benefit” spending reflected 5.1% of their expenses on par with other organizations, although many of us would be happy with only a 5% tax on our income. But as the article points out most of that is a bit of accounting hand-waving, specifically charity care and Medicaid shortfall. Charity care reflects free care provided for those unable to pay – not only is it medically unethical, it is illegal not to provide emergency care. Physicians have and do give this unrecompensed care, but payment comes in many forms. For the hospital employed physician, it is part of their job, and community physicians have successfully gotten on-call payments from hospitals for providing these services. So, I can see how charity care provides a community benefit and how it may well involve actual payments to others, at least to the extent that those services are provided by physicians not employed by the health system. But in the case of Sutter Health, few if any of their on-call physicians are not full-time employees.

Much more problematic is that Medicaid shortfall which reflects almost 55% of the community benefit. The shortfall is the difference between what Medicaid pays for a service and what the service actually costs. You would think that costs could be easily calculated, but then few of us have had the opportunity to watch a health system do the calculation – it is full of very fuzzy numbers, resulting in fuzzy costs. Perhaps an example will help. I get a Medicare payment of $1100 for performing an operation and providing the next 90 days of care [1]. In truth, I cannot calculate my cost because it includes paying for the office rent, maintenance and staff, malpractice insurance, and the most easily quantified, my time; for the sake of the discussion let us say that the payment is sufficient. Medicaid will pay me $638, so my shortfall is $462. As a physician, in private practice, I have to accept the Medicaid payment and the shortfall, well that’s my problem. For the non-profits, they report the shortfall as a benefit to the community they serve. The problem is that by declaring the shortfall in that way, they benefit themselves. You tell me whether that is in the spirit of the law? [2]

Another concern raised is how much of the community benefit returns to a specific community. Health systems cover a lot of geographies and the income of one may often provide the benefit to another, just like the federal government. For example, the complaints of New York’s state government is that for every New York dollar sent to the feds, they only get back 84 cents. And now, communities served by Sutter want to be sure that they get their fair share of Sutter’s 5% community benefit or largesse. Nothing exemplifies the problem as well as this quote from Berkeley’s mayor, “'How do they benefit the people of Berkeley?' and, 'Is the level of community benefit commensurate to their tax-exempt status?'”

Finally, there is a new healthcare cost just beginning to poke its trunk into the room – health systems paying for socioeconomic disparities that impact health, like housing, transportation, and food. There is little doubt that not being able to get to your doctor’s appointment or treatment impacts health and the same is true for not having enough food to eat or a stable place to call home that provides shelter. But is that a cost we should bear on the banner of healthcare, or does it belong in some other category? Sutter Health is already providing shelter and services to the homeless to whom they provide healthcare. That is commendable, and certainly a community benefit, but is that their role? The increasing inclusion of health care related but less direct services into health systems mission will become the elephant in the room when gym memberships and sneakers are just as required as a CT scanner or a nurse.

[1] That includes care in the hospital, and all follow-up but does not include additional surgical care that might be required, e.g., another unrelated operation or an operation to correct a complication of the first procedure.

[2] Parenthetically, I suspect that if we were to allow physicians to write off from their taxes the shortfall between Medicaid and some other standard payment, like Medicare, you might find many more providers willing to see Medicaid patients.