Spoiler alert – this is not a discussion of whether anyone should be held liable for Roundup or opioids.

In MBA school, corporations are described as legal structures to diffuse financial liability and benefits, so that the risk of innovation is spread about, as are the rewards. Monsanto and Mallinckrodt demonstrate two ways that corporations seek to shift risk while retaining rewards.

Monsanto

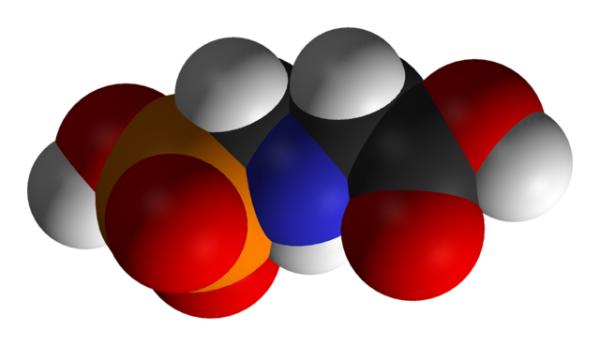

With Roundup litigation mounting, not only appearing on your television but coming directly to your inbox, you have to wonder about Bayer’s decision to purchase Monsanto, the investors certainly are asking that question. The answer may lie in GMOs. With the rise in GMO crops, hardened against some common plant pests, pesticide use has decreased. The EPA reports that between 2000 and 2012, the use of organophosphates was reduced by about 33%. On the other hand, during a similar period, the use of herbicides to control weeds, rose nearly 26%. Glyphosate was the biggest herbicide by weight used.

Bayer was founded in the mid-1800s during the rise of the German chemical industry, becoming part of IG Farben in the early 1900s. Because of their involvement with Nazi war crimes, including slave labor, egregious medical “experiments,” and the production of Zyklon B the insecticide used in the Holocaust, IG Farben was seized and broken up after World War II. Bayer resurfaced as its own company. [1] But I digress, the point, Bayer is a very large player in insecticides and herbicides.

Monsanto has its own niche, founded as a chemical company at the beginning of the 20thcentury they shifted focus moving heavily into the seed business, both natural and GMO becoming the market leader with a 26% market share. They also continued to make herbicides.

For Bayer, Monsanto was a very tempting takeover target. It exerted significant power in the seed business, and with their own “faltering” pesticide business, Monsanto’s herbicide could bolster and bring in additional profits – win-win. As it turns out, the Roundup litigation, may not have been well considered in Bayer’s “due diligence” before announcing the merger. In any case, that litigation is now dragging on Bayer’s profitability, and investors are questioning the competence of its executives. So here we have an example of a company, ingesting liability, with significant, at least short-term consequences, the business version of autophagy – eating yourself.

Mallinckrodt

An opposite approach to liability is also playing out, quietly, in this case involving Mallinckrodt and opioid lawsuits. Mallinckrodt is an “American” pharmaceutical firm, established by German immigrants in the mid-1800’s part of that same generation of scientists and entrepreneurs involved in the founding of Bayer. It is now, for tax purposes [2], based in Ireland, but as a DEA database has recently revealed, it is responsible for a little more than a third of all opioids consumed in the US – roughly 80 tablets per individual. Although Purdue has garnered all the media attention, it is #4 in the market; Mallinckrodt may be on the hook for $5 billion in damages.

Just as Bayer absorbed both Monsanto and its name, Mallinckrodt will be changing its name to Sonorant Therapeutics. More importantly, they will be spinning off the opioid producers, their generic drug division, into a new company, Mallinckrodt Inc. And in the spinning, they will protect a significant portion of their assets, leaving the liability to a firm with fewer resources, or as plaintiff’s counsel will argue, shallow pockets for financial penalties.

And while ingesting companies for profit and spinning off companies to remove liabilities are accepted legal business practices, there is something off here. It doesn’t pass the whiff test, at least for me. If corporations are individuals before the law, then they should be treated in the same way. If grandparents can be held liable for the co-signature on the student debt of their grandchildren, certainly Mallinckrodt and the ghost of Monsanto should be held to account for their misdeeds. Whether they committed misdeeds or not, is beyond the scope of this article but discussing what is fair is something we should all consider.

[1] Bayer has some experience with apologies, it’s president apologizing for the role of Bayer in those Nazi war crimes.

[2] “An Irish corporate tax inversion is a strategy in which a foreign multinational corporation acquires or merges with an Irish–based company, then shifts its legal place of incorporation to Ireland to avail itself of Ireland's favourable corporate tax regime. The multinational's majority ownership, effective headquarters and executive management remain in its home jurisdiction.” Wikipedia. Other companies besides Mallinckrodt make use of this loophole, including medical device maker Medtronic, and Apple which has located it’s intellectual property assets and their revenue streams, worth $300 billion, in Ireland.