Hospital systems are tax-exempted in exchange for an approximately 5.9% investment in community services. Those services include community health improvement (interpreters, immunizations, health fairs); community-building activities such as food assistance; contributions to community groups; and subsidized “free” clinics or services provided at a loss to the hospital. That doesn’t include the discount given by Medicaid payments, but as Lown states, discounts to other insurers are not included in community benefits either. The health systems stated expenditures for these community services were compared to Lown’s estimated value of their tax exemption. Finally, every table, not a picture, tells the story today.

“Out of 275 non-profit hospital systems evaluated, 227 spent less on charity care and community investment than the estimated value of their tax breaks — what we call a “fair share deficit.” - $18.4 billion in 2019.”

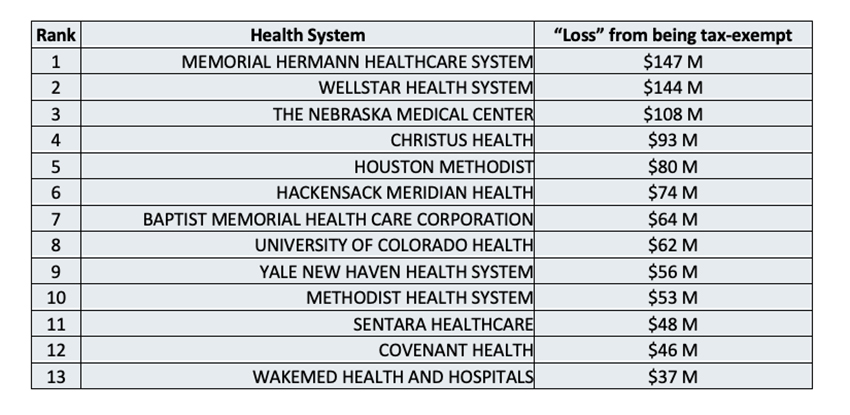

There were hospitals whose community outreach was greater than their estimated tax savings and who experienced a “loss” from their non-profit status.

Finally, this last table can be filed under the rich get richer. Non-profits were, of course, eligible to receive cash infusions to help sustain their businesses – that includes some major hospital systems.

Those negative numbers in the first column are the “profits” from their tax-exempt status; the accounting differences for operating and nonoperating income explain the differences in the totals.

Looking at the numbers, I want to be a non-profit, at least for tax purposes, too!

Source: Fair Share Spending Lown Institute