Drug Coverage’s Carrot and Stick

In 2006, Congress passed the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA), which for the first-time covered outpatient medications. (Parts A and B cover medications given in physician offices and hospitals). Those costs were covered under stand-alone “Part D” coverage or as a necessary component of Medicare Advantage, “Part C.”

In 2020, Medicare beneficiaries (those older than 65) accounted for 35% of all prescription drug spending, although they represented roughly 18% of the population. Medicare paid 64% of those costs, while commercial insurance, Part D coverage, paid 16%, and out-of-pocket expenses (including monthly premiums, co-payments, and deductibles) accounted for 13%. Without drug coverage, costs to seniors would rise to nearly 30%, so while it is technically a voluntary program, seniors are highly incentivized to participate.

In addition to that cost-reducing carrot, there is a stick: those not enrolling in a Part D or Medicare Advantage plan or entering these programs after they are initially offered at age 65 pay an additional monthly “drug coverage premium” penalty equal to the monthly cost of the plan in perpetuity. That is a big financial stick!

As with all things Congressional drug coverage, the proverbial horse created by a committee is more like a camel and involves a variety of thresholds and exemptions, including government payment of premiums and out-of-pocket costs for the roughly 28% of seniors whose income is below a certain income level. Part D plans involve standard benefits with the costs shared between the enrollee, the plan, the drug manufacturer, and the federal government. Plans may vary regarding which drugs are more heavily subsidized than others using “formulary tiers,” and many plans offer “enhanced” benefits with lower cost-sharing [1]. Stand-alone Part D plans charge an unsubsidized additional premium to cover those enhancements, while supplemental payments from Medicare finance Medicare Advantage enhancements.

Deficit Reduction alters the marketplace

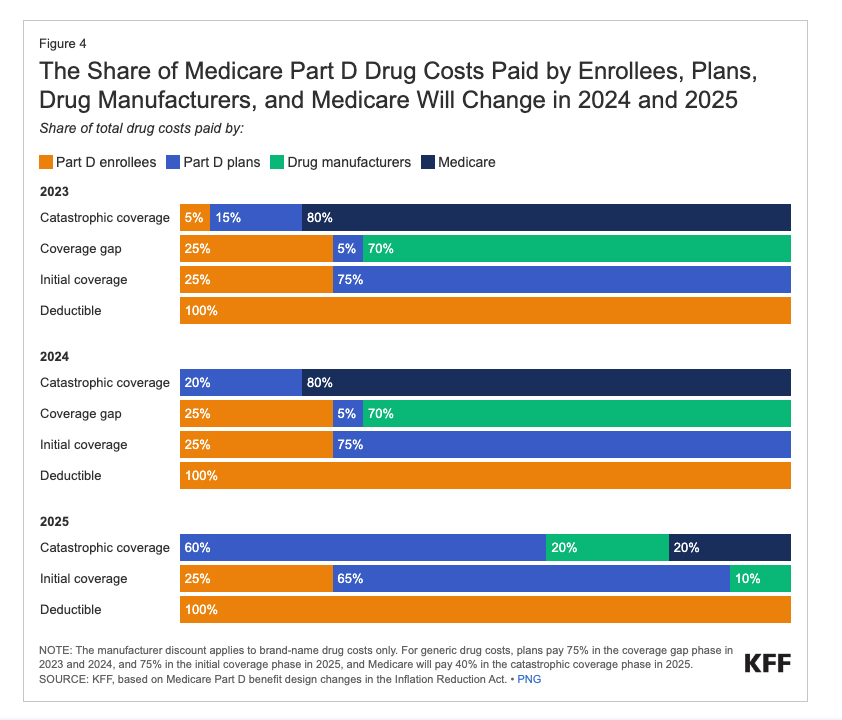

The Deficit Reduction Act (DRA), in addition to introducing federal government negotiations for their drug spending, changed the drug coverage programs, altering the marketplace. In the past, the general schema for stand-alone Part D programs included the following:

- A monthly premium and an initial deductible costs.

- After meeting their initial deductible, the enrollee entered the initial coverage phase, paying 25% of costs while the Part D plan covers 75%.

- At the next threshold, they enter the coverage gap, where beneficiaries continue to pay 25% of drug costs. The manufacturer provides a 70% discount for brand-name drugs, with the Part D plan paying 5%; for generic drugs, the plan covers 75%, with the enrollee remaining in this phase until their out-of-pocket spending reaches $6,550.

- Finally passing through that last financial threshold, they enter the catastrophic phase, where Part D covers 15%, the federal government pays 80%, and the enrollee is responsible for 5%,

Thanks to the DRA, beneficiaries have a $2,000 cap placed on out-of-pocket spending and an end to catastrophic phase co-payments. [2] There are also reductions in the share paid by Medicare, with those costs being transferred to Part D plans or manufacturers. This graphic by the Kaiser Family Foundation captures the changes.

The Invisible Hand Responds

Capping enrollees' out-of-pocket costs will increase federal spending by shifting costs from enrollees to plans, as the federal “subsidy” covers 74.5% of plans' expected spending. The cap is anticipated to boost drug utilization, further raising federal costs, though lower spending on other healthcare services might offset some of the rise.

Moving the more significant portion of the manufacturer’s required discount to the catastrophic phase could reduce prices to maintain beneficiary spending in the coverage gap where the discount was the least. Alternatively, it might encourage manufacturers to raise prices on some drugs to increase the revenues to negate the impact of the larger discount.

There is a 6% increase for beneficiaries, the highest allowable under the law, in the baseline benefit premium to $36.78 monthly. However, the true rise in premiums will be announced later this month for the 62% of stand-alone Part D programs that are “enhanced.” It is anticipated that for the stand-alone programs, where the cost is already several-fold greater than the Medicare Advantage, there will be larger premiums. For those in Medicare Advantage, where 79% have enhanced drug coverage, an upward change in premiums is anticipated for some, but not all.

In the new marketplace, more of the cost burden rests with the drug coverage plans. The stand-alone programs are very limited in reducing these new burdens. They can, by changing the “tier” of a medication within their formulary or changing a medication’s cost-sharing – you can expect more medications with greater co-payments. Medicare Advantage can offer free drug coverage and “enhanced services” for various reasons. In particular, its revenue is based more on patients-at-risk and its “bid” to provide these services. [3]

I have written about how easily gamed patient risk enhances Medicare Advantage payments. Medicare Advantage can also offer lower costs for Part A and B because these plans have “narrow” networks of hospitals and physicians who have accepted payments for care that are lower than those they might get from Medicare. The gross margin, the revenue left after all costs but before deducting for administrative expenses, for Medicare Advantage in 2023 was $1982.

These changes are making stand-alone Part D drug coverage less profitable than the already very profitable Medicare Advantage plans. As reported by STAT, Centene, the largest broker of Part D coverage, has ended incentives to their brokers, a $65 commission for each individual signed up or renewing a stand-alone Part D plan. These brokers, who are not fiduciaries, requiring them to act in the best interest of their client, you, may begin to steer individuals to the still “commissioned” Medicare Advantage programs where 75% of their enrollees have “free” drug coverage.

There is no free lunch

These changes may accelerate the shift from traditional Medicare to Medicare Advantage, which already serves 54% of the eligible Medicare population. Who can resist free? Medicare Advantage was posited as the free-market, privatized version of Medicare and was thought of as capitalism’s opponent of Medicare for All. However, as the Kaiser Family Foundation reports:

“Generally, research shows that Medicare pays more to private Medicare Advantage plans for enrollees than their costs would be in traditional Medicare. The Medicare Payment Advisory Commission (MedPAC) reports that plans receive payments from CMS that are 122% of spending for similar beneficiaries in traditional Medicare, on average, translating to an estimated $83 billion in higher spending in 2024.”

As we watch the inevitable shift from traditional Medicare to the shiny “free” Medicare Advantage programs, let’s remember that there’s no such thing as a free lunch. If it sounds too good to be true, it often isn’t true. We, the people, pay all the bills – through premiums, deductibles, co-pays, or our taxes.

[1] Most plans deviate from the standard benefit package but must be equivalent to the same average total drug expenditures. Plans may, therefore, target specific drugs with higher or lower co-payments.

[2] The 25% cost-sharing in the initial coverage phase will not change although few plans charge the 25% currently opting instead to have varying cost-sharing amounts based upon the specific drug.

[3] When a Medicare Advantage program’s bid for the costs of providing Medicare Part A and B services are below the CMS benchmark, they are given additional rebates. These rebates in 2024 reflected an extra $2300 for each beneficiary, contributing to the availability of zero-premium plans.