Over the course of the past few weeks Mylan has replaced Turing and Valeant as the most scrutinized and critiqued pharmaceutical companies in the United States. Though politicians and pundits have claimed the problem is Big Pharma, the issue of price-gouging is far more pervasive among generic drugs.

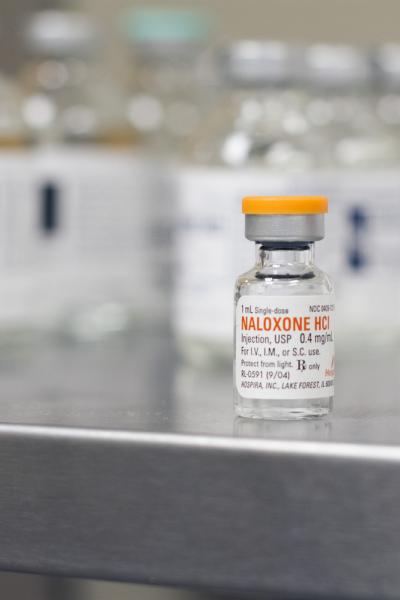

The staggering price increases of the Mylan EpiPen, which is used in cases of anaphylaxis related to severe allergies, resulted in a new wave of criticism from policymakers to doctors to patients. But the issue actually speaks to the underlying and pervasive price gouging that has long been a component of the generic drug industry. The EpiPen was simply the latest example. Before the EpiPen, naloxone, which is used primarily for reversal of overdoses in adult opioid addicts, had a similar debacle. And yet generic companies continue to get some sort of ethical halo among politicians and the public while companies that do new drug discovery, and actually produce something that requires research, are criticized

The first time I encountered naloxone, I was a third year medical student in one of the delivery suites at a tertiary care facility and a baby had just been handed to the pediatrician on call who recognized immediately there was severe respiratory depression, despite adequate stimulation and supplemental oxygen due to opiods. By 2014, the CDC disclosed an opioid overdose epidemic because of a record 28,000 opioid-related deaths that year. Suddenly the market for the use of naloxone outside of a hospital setting was justified and so almost every supplier of naloxone followed with an equally "justified" price hike, examples of which are shown in the table below.

| Company | Route of Delivery | Starting Price (Year) | Current Price (Year) |

| Adapt | Nasal spray | $63 per single dose spray unit (2016) | Same |

| Amphastar | Injectable | $12 per dose (2001) | $41 per dose (2015) |

|

Hospira/Pfizer |

Injectable | $0.92 per dose (2005) | $15.80 per dose (2014) |

| Kaleo | Auto-injector | $287.50 per single-dose injector (2014) | $2,250 per single dose injector (2016) |

| Mylan | Injectable | N/A (2014) | $23.70 per vial (2016) |

There have been no major developments or alterations to the actual chemical constituents of naloxone, greater demand should equal a higher manufacturing supply to match, since the product is generic.

So why the exorbitant price increases? Companies like Kaleo claim increased manufacturing and marketing costs because their product has been designed specifically for use by non-medical people. Kaleo's auto-injector, Evzio, acts similarly to the EpiPen in an emergency situation. That the four other pharmaceutical companies jumped onto the price gouging train is less clear, but a knowledge of the regulatory environment can make it more so.

Between 2008 and 2014 the market was dominated by Amphastar and Hospira but as of 2016, five pharmaceutical companies carry some form of naloxone. Kaleo's auto-injector led to their price increases. Okay. And earlier this year Adapt released its nasal spray form of naloxone, Narcan. The route of administration is a competitive benefit and that can warrant a premium.

But like with people who want to buy epinephrine and a syringe instead of mortgaging their home to buy EpiPens every year, if capitalism were actually in effect there would be choices across the spectrum, just like you can pay for an expensive strawberry that used the organic process or get the same strawberry using conventional agriculture.

There isn't. Supply and demand is not in effect, because policy makers have increased the demand by advocating for increased use of naloxone. It's even being stored at high schools. Congress is currently due to vote on a bill that would require the prescription of naloxone along with any doctor prescribed opioids.

Yet it will take you years and millions of dollars to get a competitor on the marketplace, even though it's a generic. The backlog of generic products is 4,000 waiting for regulatory approval. If you have a company and want to get into this business, you have to show your version is safe, which means a million dollars and up per year in employees plus $2 million to spend on testing. Venture capitalists like original drug discovery because there is a real upside if a product is successful, but with a generic they are going to invest and wait years to get approval, knowing the free market may have invented something better by then.

Nonetheless, the need for naloxone remains. Much like the EpiPen, it can be essential. Companies are responding to a finite supply and increased market and raising their prices, but government regulators have created an artificial blockade to solving that problem - and while the people impacted are often those much of the public doesn't have a lot of sympathy for, we're all paying the price for bureaucratic red tape that prevents the issue from being solved.

NOTES:

Table summary of cost trends with regards to naloxone pricing was sourced from articles by The Business Insider and The LA Times.