Last week, Merck filed suit against the US Department of Health and Human Services to prevent them from implementing drug pricing provision of the Inflation Reduction Act. The Inflation Reduction Act that includes initiatives to force reductions in prescription drug pricing by the pharmaceutical industry. It achieves this reduction by allowing HHS to negotiate drug prices for used for Medicare patients and by limiting price increases for drugs paid for by Medicare part B to the rate of inflation. Drug companies would be forced to rebate Medicare for price increases beyond the rate of inflation.

The pharmaceutical industry is up in arms about this new law and its implementation as planned by HHS. They say that innovation will be threatened. Jobs will be lost. And that may be true. The reason is that their profits will be reduced significantly. Why?

The US pharmaceutical market is the wild west. Given the web of drug producers, middle men, insurance companies, pharmacies and who knows what else, companies can charge much higher prices here than in most of the rest of the developed world. We pay on average about 30% more for drugs in the US. What does this mean for the industry and how does the US compare to other countries?

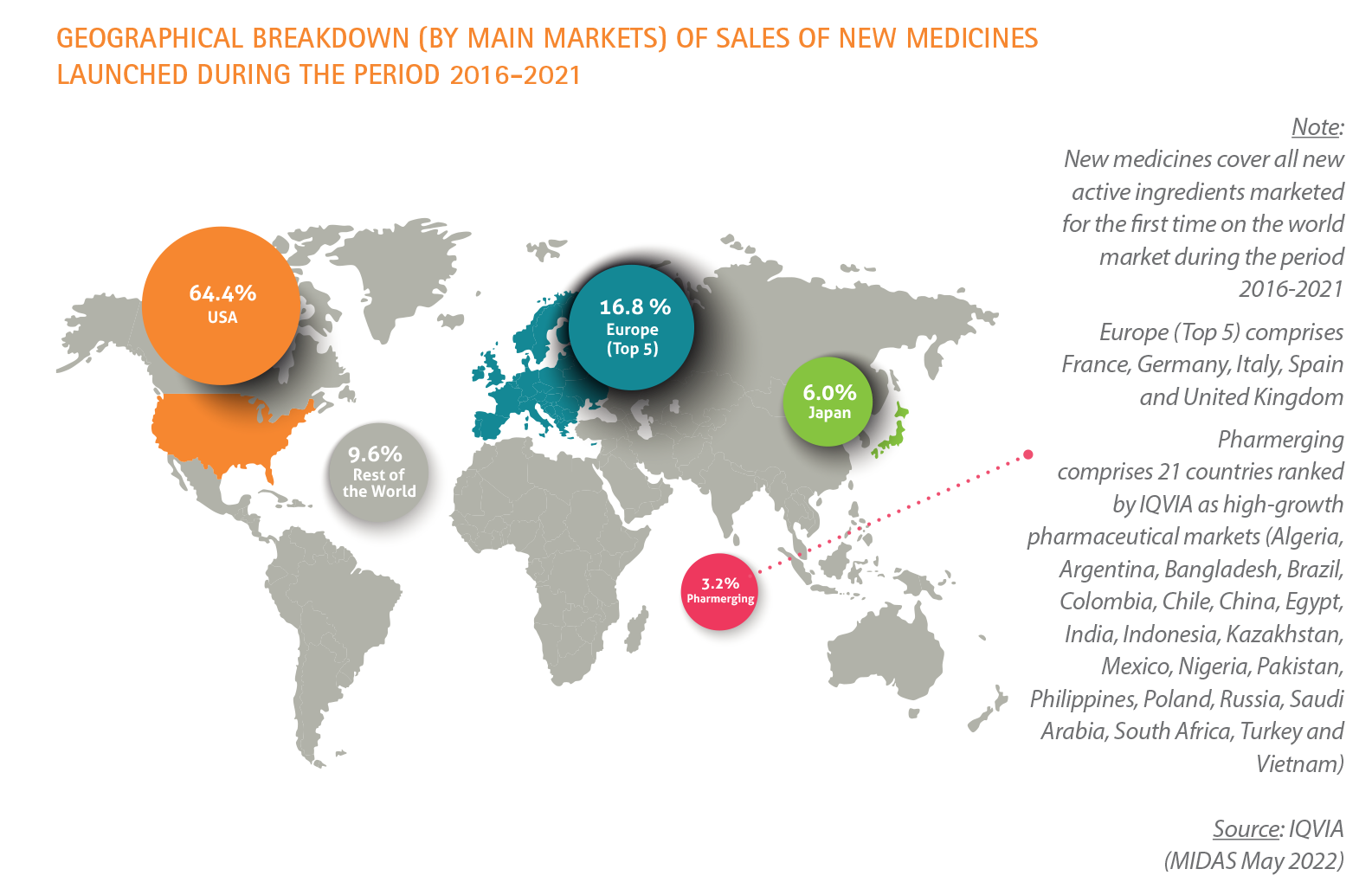

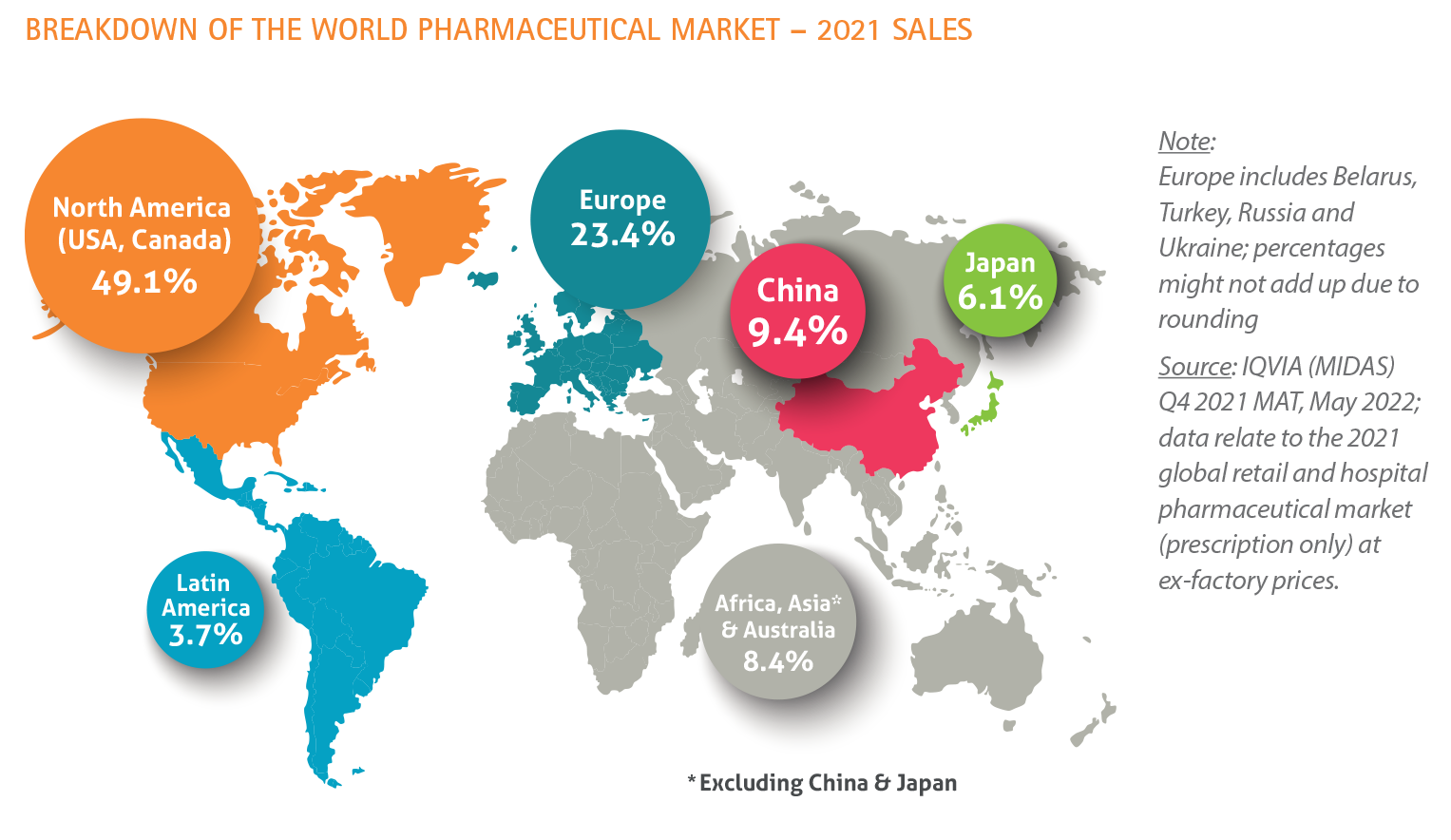

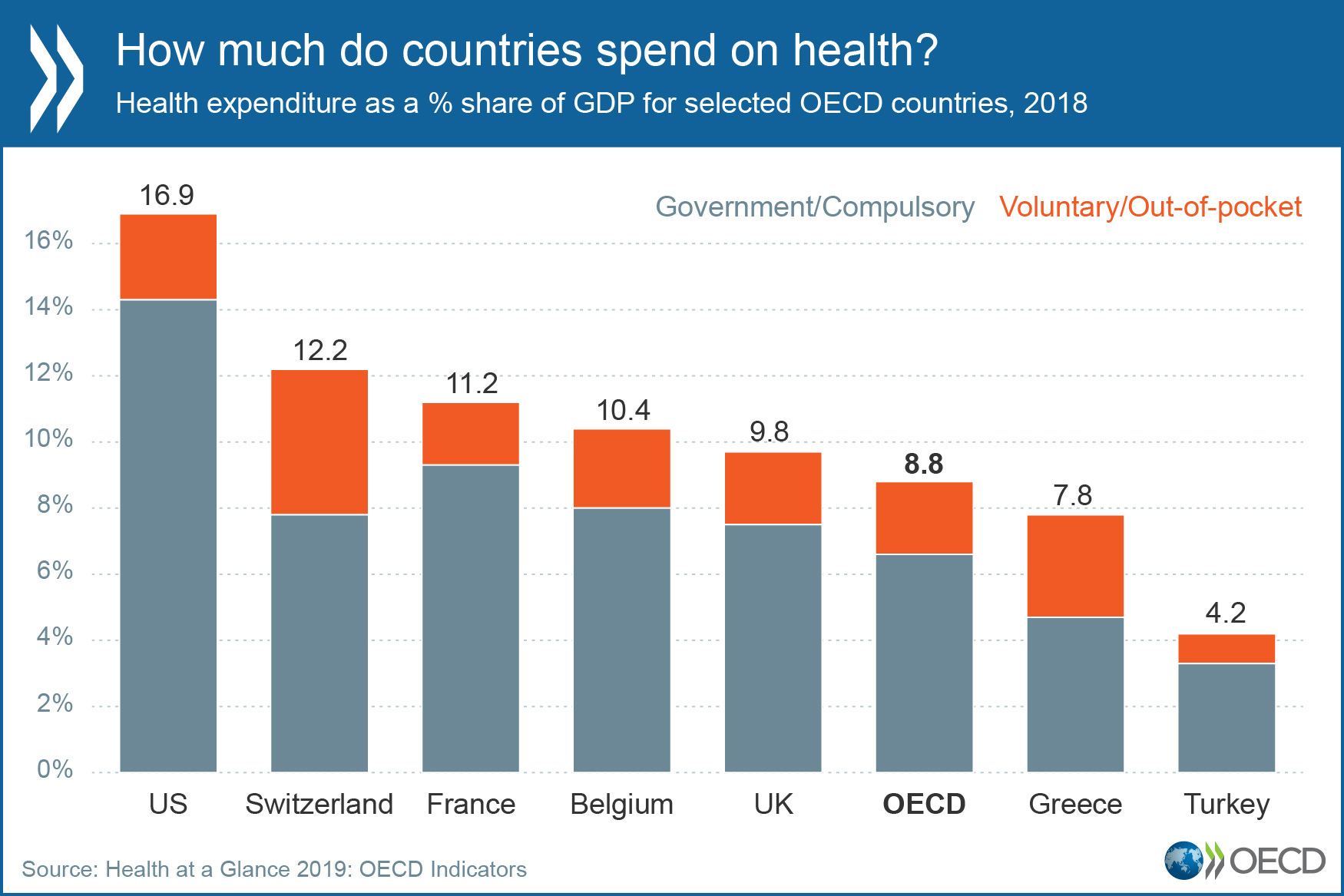

As shown below EFPIA the US accounts for a staggering 49% of the global pharmaceutical market and for 64% of global pharmaceutical sales revenues for recently launched medicines. At the same time, investment in R&D tends to be higher in the US when compared to say, Europe. The US spends 17% of its GDP on healthcare (including medicines) – about twice the average expenditure of countries belonging to the Organization for Economic Co-operation and Development.

I have argued for years that the US has essentially been subsidizing pharmaceutical innovation for the rest of the world just by virtue of its drug pricing structure (or lack thereof). Pharma says that innovation will suffer. I say that if the rest of the world wants to chip in a little more – more power to them. If not, then not.

It is true that we in the US tend to have better access to new medicines than other countries. (We certainly pay for that access). That is especially true for Europe. In Europe, a single regulatory body, the European Medicines Agency, makes market approval decisions for all of Europe (now no longer including the UK). But each individual country makes its own decision on pricing. There are several different mechanisms for deciding on preferred price points among European countries. This means that some countries will simply not have access to new medicines when companies decide that the chosen price points are too low to provide for a return on their investment. A recent example shows that of 29 new medicines approved by the EMA in 2019, Germany and Denmark had access to only 22 of them.

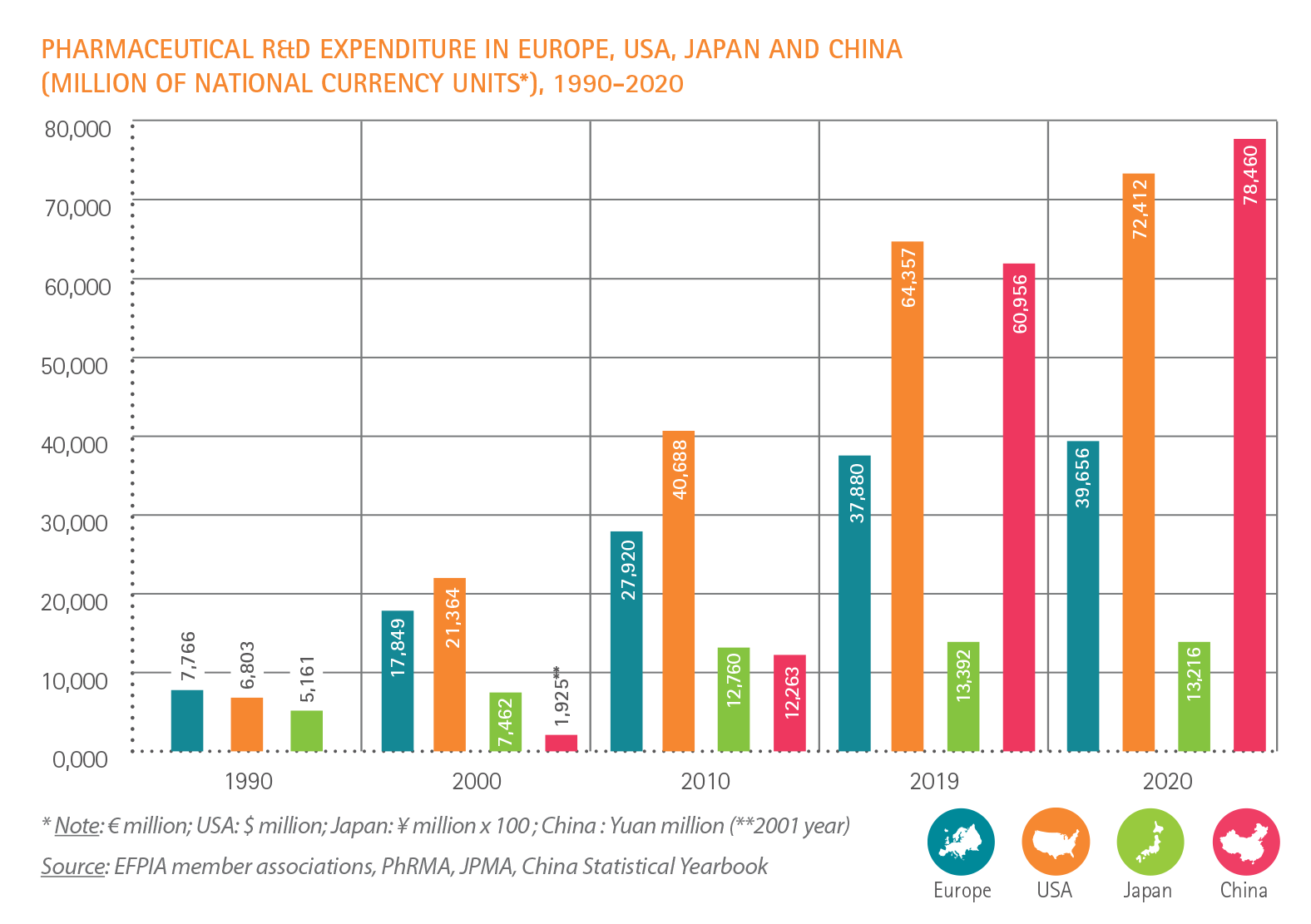

The price point negotiation results in Europe having a much lower market share than the US in spite of having a larger population than the US (445 vs 333 million) (see charts above). It also results in a much lower pharmaceutical R&D investment than is seen in the US. It turns out that now the pharmaceutical industry plows about 25% of their revenues back into R&D – that’s more than twice as much as when I was working. Clearly, the lower the revenues, the lower the R&D investment.

The industry regularly emphasizes the risk of their R&D investment. They note that the cost of bringing a single new medicine to the market, including the costs of all the failures incurred along the way, is now over $2.5 billion. Only two out of 10,000 molecules discovered in laboratories searching for new medicines will make it to the market. It takes an average of 12-15 years to get from lab discovery all the way to market approval. So yes, pharmaceutical R&D is high risk and takes a long time.

Do new medicines provide value? Are you kidding? From penicillin and antibiotics (that actually cure disease) to the vaccines (that prevent disease) to new treatments for cancer and diabetes and high blood pressure – there is no question about that. Does the industry gouge consumers on prices when it can? Too often. Does it market its products in questionable ways like its direct-to-consumer advertising? Yes (in my humble opinion).

Understanding all this context, the question is, are we willing to forgo some of the pharmaceutical industry’s investment in US R&D in order to achieve lower drug prices. My own belief is that we need to find a way to share the financial load more equitably across the developed economies of the world. Negotiating drug prices for Medicare patients seems to me to be a good start.