Interest rates are a significant factor in the health of any economy. They play a role in our personal lives in a very real way: High-interest rates prevent people from taking out loans to pay for a new house or car, and they limit how much people charge to their credit cards. In general, high-interest rates decrease our ability to buy the things we need or want.

This also applies to governments. Governments do not have an infinite supply of money. We know this is true because governments that have tried to create one (by printing money) experience hyperinflation. Last year, Argentina’s annual inflation rate was 211%. To put this into perspective, Americans were complaining when inflation hit 8% in 2022.

The point is that markets force governments to live within their means. When a government borrows money, it must make interest payments — just like you do when you borrow money. And when those interest payments become too large, it prevents the government from spending money on other things, like essential services. The U.S. government is now recklessly flirting with this scenario.

How bad is it?

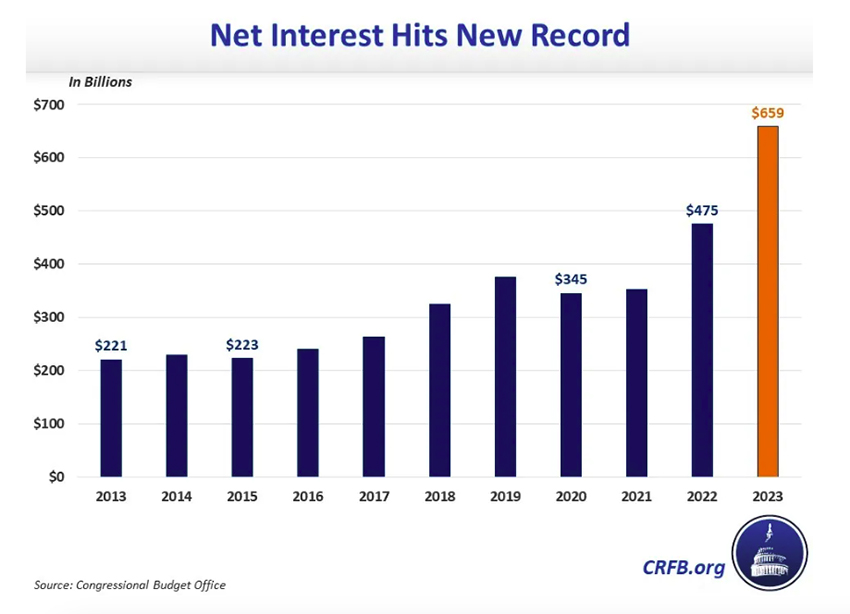

There’s no point in blaming either Democrats or Republicans. The truth is that both parties are profligate spenders. Over the past several years, unfunded fiscal policies (like stimulus packages and tax cuts), the COVID pandemic, supply chain issues, wars, burgeoning entitlement spending, and higher interest rates have conspired to drive up both the national debt and the cost of servicing that debt. As a result, interest payments ballooned to $659 billion in 2023.

Source: Committee for a Responsible Federal Budget / Congressional Budget Office

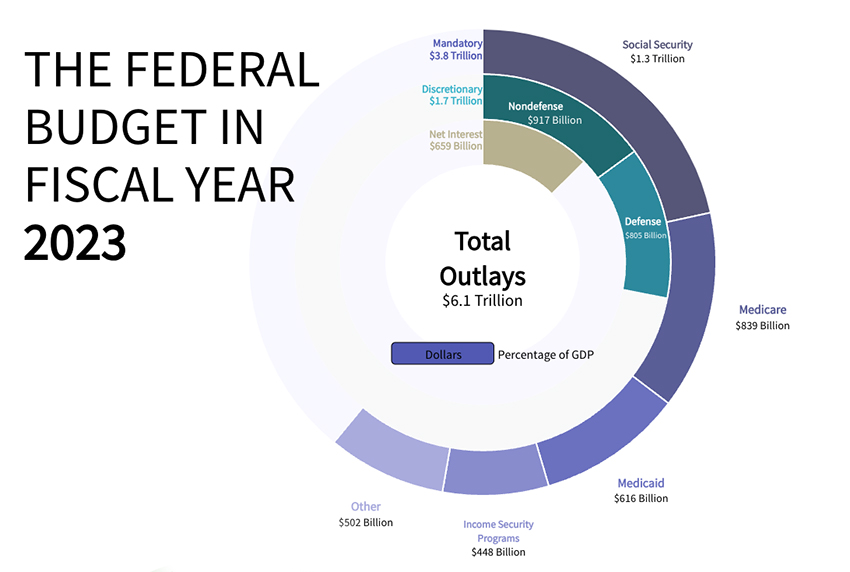

Just how much money is $659 billion? The entire federal budget was $6.1 trillion, meaning that more than 10% of the federal government’s spending went toward interest payments. In other words, for every $10 the federal government spends, more than $1 is used to pay off interest.

Source: Congressional Budget Office

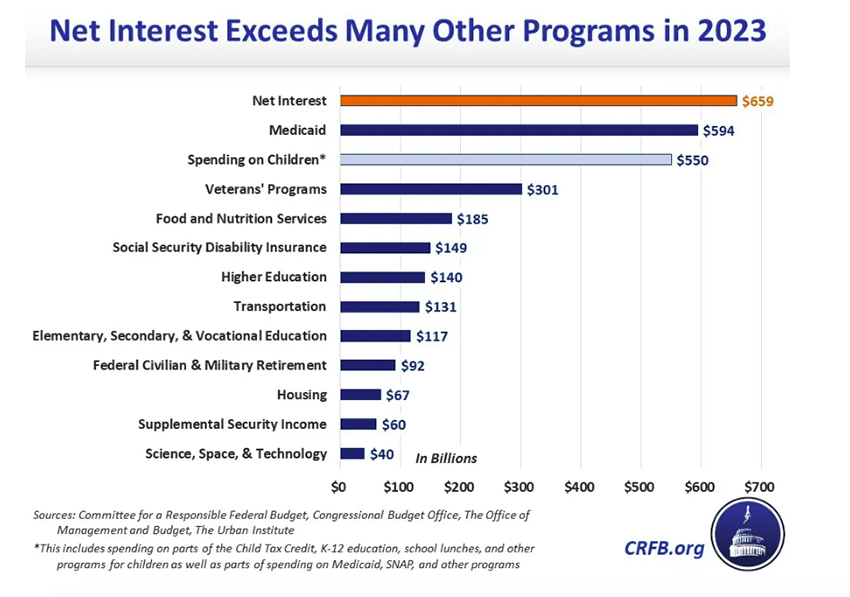

$659 billion is very close to the amount we spend on defense ($805 billion) and Medicare ($839 billion), and it’s more than we spend on Medicaid ($616 billion). In fact, we spend more money on servicing the national debt than a whole host of federal programs. (Note: The following graphic shows a slightly different figure for Medicaid spending, $594 billion.)

Source: Committee for a Responsible Federal Budget, et al.

Without a major shift in policy, things are only going to get worse. According to the Committee for a Responsible Federal Budget, the U.S. is adding $2 trillion every single year to its national debt, which currently stands at about $33 trillion. Just five years ago, it was only $22 trillion; ten years ago, it was $17.5 trillion. Additionally, as older debt (issued at lower interest rates) is rolled over, the government has to refinance at a higher rate.

Concluding that this trajectory is not sustainable is an understatement. This year, the Wall Street Journal says that interest payments ($870 billion) are expected to surpass defense spending ($850 billion). Last week, The Economist wrote that the U.S. national debt is a danger to the global economy.

Crowding out

Though the national debt feels like an abstract academic concept, it isn’t. The debt itself can wreak economic havoc, a phenomenon known as “crowding out.” When the government needs to borrow money, it often gets that money from investors (in the form of government bonds like 10-year Treasury notes). But investor money is not unlimited. Other entities, like established businesses and startups, also need investor money. Competition for this money drives up the cost of borrowing that money — the interest rate. So, the more the government borrows, the higher the interest rate for everyone.

Simultaneously, every dollar invested in government debt is a dollar that cannot be invested elsewhere. That means businesses that need to borrow substantial amounts of money to finance major projects like expansion or research cannot do so because the borrowing costs are too high.

Why the national debt is a public health threat

And that is precisely why the national debt is a public health threat. Biotech companies and the venture capitalists who invest in them are having difficulty raising money, and layoffs are plaguing the industry. Even large pharmaceutical companies, which many assume are swimming in cash, are cutting back. Bristol Myers Squibb is set to lay off about 6% of its workforce, some 2200 people.

To be sure, the national debt affects all industries, and the troubles facing the biotech and pharma industries cannot solely or even largely be blamed on the national debt. It is simply one factor among many. But it is a factor that the government can control — but chooses not to.

Over the next decade, 84% of the growth in federal government spending will be due to healthcare, Social Security, and interest payments. Without serious reform, the government will need to borrow yet more money to pay for these increased costs, exacerbating the aforementioned issues. Combined, this threatens to underfund basic services like Medicare as well as health innovation in America. Money problems inevitably lead to health problems.