Pfizer was recently in the news over ‘their’ shortage of Bicillin and the NY Times reports that Pfizer is also responsible for the lack of another crucial medication, sodium bicarbonate – the ubiquitous kitchen product that most of us use either to bake or to keep our refrigerators smelling fresh. Shortages of pharmaceuticals is a persistent problem. As a physician, I have been asked to postponed elective care while drugs in short supply were prioritized to more critical patients and I have had that experience working in academic medical centers and small rural hospitals. The drugs in shortage always seem to be so odd, among the current shortages are not only sodium bicarbonate, but normal saline (salt water) that we use in nearly every intravenous line we place, injectable glucose and injectable lidocaine (a local anesthetic that anyone with a cavity is acquainted). Why?

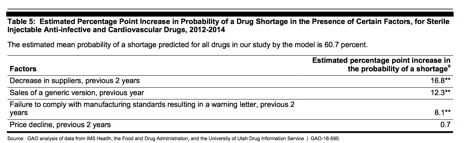

Rather than continue to blame greed or hidden agendas perhaps we might consider other possibilities. Several of the factors associated with the drugs shortages are found in a report from the federal Government Accountability Office (GAO). They looked at shortages of injectable drugs which account for 65% of all shortages; specifically, anti-infectives and cardiovascular drugs because they were among the most common shortages accounting for 25% of the total (e.g. Pfizer’s Bicillin and sodium bicarbonate). Here is what they found:

Let’s break this down into ‘bite-size’ pieces. The largest factor, a decrease in manufacturers, along with generic sales and price declines account for a large part of GAO’s prediction model and are unique qualities of this market. Among the salient market conditions are:

- Limited inventory – Just-in-time inventory refers to efficiency/economic practices where you only acquire materials as they are needed, lowering your storage costs. Manufacturers have a two to three-month inventory, wholesalers only a month, and hospital/physician end users a few weeks of stock. It is a very tightly coupled supply system, and when there is a disruption, the efficiency of the coupling becomes the system’s fragility – there simply is not enough slack (really stockpiles) to smooth out the disruption that the end user experiences. You would think the solution is simply to ramp up production.

- Production complexity – the production of sterile injectable pharmaceuticals is complex especially maintaining sterility throughout the manufacturing process. This often requires dedicated production lines or facilities. The classic example is penicillin, which due to the risk of cross-allergenic reactions is made in a facility that makes no other product. As a result, for any given production line there is a limit (bottleneck) to how much can be produced. Fair enough, the solution, therefore, would be to create another or bigger production line.

- Constrained manufacturing capacity – Generic drug manufacturing (and they are the predominant drugs in shortage) is highly competitive and highly concentrated. Very few companies produce generics, so most of these manufacturers set up a production line and make one product, reset their production facilities and make the next drug, and so on. There is time required to switch from one product to another, there are production schedules and ramping up production of a drug in shortage takes time. The additional lag time of resetting production lines exacerbates the shortages produced by just-in-time inventory. The preponderance of shortages can be accounted for by seven manufacturer’s [1]

There are two additional dynamics in this market, price, and regulation. Here is what the GAO has to say about the pricing of drugs in shortage.

"Additionally, our finding that sales of a generic version were associated with shortages suggests that relatively low profit margins may also trigger shortages for sterile injectable drugs. … The 88 drugs in our study sold generically were available from an average of four suppliers during 2013, and 10 drugs had eight or more suppliers. Researchers have found that prices, and consequently profit margins, decline for generic drugs as the number of suppliers increase. Relatively low profit margins may cause suppliers to exit the market for less profitable drugs in favor of more profitable ones or may make it unprofitable to increase supply, which could make the market vulnerable to shortages.”

Generic drugs are commodities and like many, if not all commodities, are sold at the lowest price possible. In many instances the federal government has set the price they will pay for these generics, creating price controls. In general price controls distort the market, and when the prices are set too low, shortages result.

The other consideration is the role of the FDA in the manufacturing process. Before a manufacturer can produce a pharmaceutical, it must receive FDA approval and again when manufacturing conditions or processes change with a “potential to adversely affect factors such as the identity, strength, quality, purity or potency of the drug.” While the average drug shortage last 418 days, an expedited FDA review to approve a new manufacturer or new process takes at least a year. So just approving a new manufacturer will not resolve shortages.

The other consideration is the role of the FDA in the manufacturing process. Before a manufacturer can produce a pharmaceutical, it must receive FDA approval and again when manufacturing conditions or processes change with a “potential to adversely affect factors such as the identity, strength, quality, purity or potency of the drug.” While the average drug shortage last 418 days, an expedited FDA review to approve a new manufacturer or new process takes at least a year. So just approving a new manufacturer will not resolve shortages.

Additionally, the GAO found little evidence that FDA enforcement, as measured by ‘letters of warning’ to generic pharmaceutical manufacturers had increased – in fact, they represented the outcome for only 5% of their inspections. Seven manufacturers slow or stopped production because of these warning letters, as they should because foreign materials like glass and metal shavings had been found in their products. And further evidence showed that these manufacturers had been problematic for some time, the warning letters did not resolve the problems. The GAO concluded:

"While the strong association between failure to comply with manufacturing standards resulting in the receipt of a warning letter and shortages could support the contention that FDA regulatory activity triggered some shortages, it could also support the contention that there were growing manufacturing problems and possibly related quality concerns that both precipitated the warning letters and led to shortages. The findings of one study indicate that supply disruptions that led to recent shortages of problems stem from various sources, including insufficient maintenance, outdated or inadequate design of sterile manufacturing processes, and poor oversight that does not test for or respond adequately to indicators of potential quality problems."

These are issues that can be corrected if the price for these commodity drugs is increased. It is not an attractive position to suggest that we raise some drug prices (or lift price controls). But perhaps we are being “penny wise and pound foolish.”

[1] Many ‘manufacturers’ repackage and relabel products made, in turn, by their suppliers. For example, Pfizer’s Bicillin is made from active pharmaceutical ingredients (API) obtained from only four sources.